Arrays of Agricultural topics 👉Choose-Write-Post#3

Greetings my dear friends of Steemit and Steem-Agro

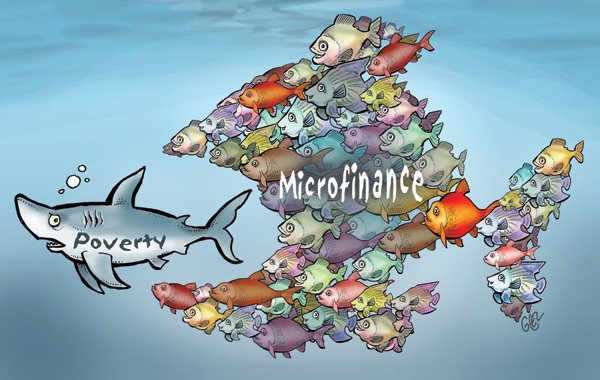

MICROFINANCING

The word Micro means very small, and financing in general refers to making financial services available, particularly the credit facilities.

Thus the term "Microfinance describes financial services to the low income individuals or those who do not have access to typical banking services. The amount of credit given is extremely small, hence the name "Microfinance

Grameen Bank, Banglartesh, founded iragi by Dis the first Microfinance institution (MFI) in the world.

It is the key strategy in helping poor people to become financially independent, more resilient and capable of providing for their families in times of economic difficulty.

According to the Consultative Group to Assist the Poor (CGAP), "microfinance the supply of loans, savings, insurance and other basic financial services to the poor:

Technology

Provision of inputs

Industrial growth

Reduction in inequality

Provide market for farm products

Infrastructure in rural areas

Microfinance provides financial services to micro entrepreneurs and small businesses which lack access to banking services due to high transaction costs associated with serving these clients.

Two leyer mechanisms are indeed for delivery of financial services to sach clients:

Relationship based banking for individual entrepreneurs and small businesses

Group based models, where several entrepreneurs come together to apply for loans and other financial services as a group

MFI's generally charge a higher rate of interest (around 20% per annum) due to increased cost of servicing clients and higher credit risk.

NABARD (National Bank for Agricultural and Rural Development) promoted microfinance through it's SHG-BPL (Self Help Group-Bank Linkage Program) scheme. Commercial Banks also have a microfinance department

In fact SHG-BPL has become the largest microfinancing in the world, in terms of client base and outreach.

Bandhan, which started as a Microfinancing Institution gained tremendous success and eventually went on to become a full-fledged bank.

| ADVANTAGES | PROBLEMS |

|---|---|

| 1. Less default rates | Inadequate loan funds |

| 2. Women empowerment | Inadequate institutional capacities |

| 3. Education | Poor coordination |

| 4. Enhanced welfare | Lack of participation of beneficiaries in planning microfinance programs |

| 5. Sustainability | Lack of effective training programs |

| 6. Reduction in poverty | Attempt by govt. to use it as a tool to gain political favor and stability |

| 7. Employment generation | Higher interest rates can lead to a debt trap for borrowers |

PROSPECTS OF MICROFINANCE

Expansion of MF can go beyond the traditional institutions. New players like distribution networks and mobile operators will assist in offering products and services at cheaper costs to the poor and underprivileged.

New technologies like online banks will help to market these large scale offerings

Regulations are expected to improve to facilitate ease for clients

Financial inclusion will become reality in most parts of the world

Technological advances will also cause structural changes in MF sector. Technological innovations will lead to provision of diverse financial services like insurance, savings and credit using a low cost payment infrastructure.

Mobile banking software and services will ensure better access to MF services in developing a country like India.

Thank you for reading my post.

I would like to invite three fellow Steemians to participate in the contest.

@sabbirakib

@saintkelvin17

@chiagoziee

X Link

https://x.com/Saha_tweet/status/1898497294464438440

@tipu curate

;) Holisss...

--

This is a manual curation from the @tipU Curation Project.