Analysis Of Markets And Opportunities With Ethereum.

The importance of paying attention to opportunities in markets beyond the Bitcoin ETF.

It focuses on the technical analysis of Bitcoin and Ethereum, highlighting possible key levels and trends.

In the last few hours time frame, Bitcoin has seen a slight drop after an uptrend.

The key level to watch is around 25,300, if this level holds the outlook is favorable.

From a technical point of view, it is important to stay above a red line and wait for a catalyst to break above the next resistance level at 26,500.

Ethereum could be undervalued and one of the biggest winners in the next bull phase.

On the weekly time frame, there is a falling wedge that could break higher in the future.

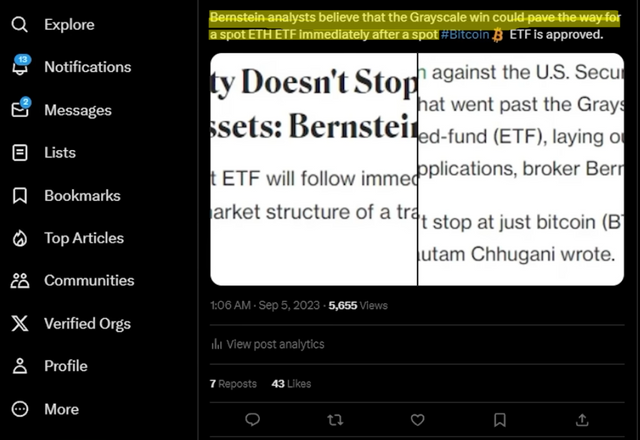

Analysts believe that the recent legal victory related to Grayscale may pave the way for a spot (physical) ETF for Ethereum.

There are pending applications for future ETFs and evidence suggests the SEC could approve them soon.

This analysis delves into the reasons why Ethereum could have a positive value in the future, including the possibility of ETF approval and legal arguments related to Bitcoin.

Before the switch to proof-of-stake, 3.7 million Ethereum would have been issued.

Currently, there are only around 300,000 Ethereum in circulation.

This scarcity contributes to Ethereum being deflationary and an increase in its value is expected.

How the growing use of Ethereum is leading to increased supply burn, further contributing to its scarcity and potential price rise. Furthermore, it is mentioned that users can earn a 4% return when using Ethereum.

The growing use of Ethereum is leading to increased supply burn.

This further increases shortages and can drive up prices.

Users can earn a 4% return when using Ethereum.

How the burning of Ethereum offsets the inflation generated by its issuance. Even though more Ethereum is being issued, supply burning counteracts this effect and maintains a balance between inflation and deflation.

The burning of Ethereum offsets the inflation generated by its issuance.

Despite more Ethereum being issued, the balance between inflation and deflation is maintained thanks to the burning of supply.

The SEC has given the green light to futures ETFs for Ethereum, indicating possible approval of spot ETFs in the future.

The arguments used by the SEC against a spot ETF for Bitcoin are no longer valid due to the existence of future ETFs.

Spot ETFs are expected to be approved once the spot ETF for Bitcoin has been approved.

The potential opportunities with Ethereum and highlights the importance of remaining attentive to the market.

Positive valuation for Ethereum

Here he emphasizes that Ethereum could be a great opportunity during this bull market.

The possible approval of spot ETFs and favorable legal arguments support this view.

Users are urged to pay attention to both Bitcoin and Ethereum as there are opportunities beyond the popular Bitcoin ETF.

Remember to keep an eye on news and regulatory developments that could affect the market.

There is talk about the limited issuance of Ethereum and how this contributes to its scarcity.

It is mentioned that compared to the old proof-of-work system, where 3.7 million Ethereum would have been issued, there are currently only around 300,000 Ethereum in circulation.

This makes Ethereum deflationary and is expected to increase in value due to growing demand.

Binance's product manager has left the company, which could be related to a series of reports regarding a sealed court case by the SEC (Securities and Exchange Commission). There is speculation that this could have significant legal implications for Binance, possibly related to sanctions.

The product manager has left Binance.

Reports suggest a possible sealed court case by the SEC.

This could have significant legal implications for Binance, possibly related to sanctions.

If the legal implications for Binance turn out to be true, there is likely to be a big drop in the crypto market. However, it is indicated that he would take advantage of this drop to buy more cryptocurrencies, as he hopes to make great profits in the long term.

If the implications legal for Binance are confirmed, there is likely to be a big drop in the crypto market.

Here we can raise and take advantage of this drop to buy more cryptocurrencies and obtain long-term benefits.

My accumulation strategy by gradually buying during market declines. He also points out that when things get "crazy," you'll expect to make big profits because of your previous purchases.

An accumulation strategy is used by buying during market declines.

You expect to make huge profits when the market becomes volatile due to your previous purchases.

✅ SteemPro Official

........Download SteemPro Mobile.

https://play.google.com/store/apps/details?id=com.steempro.mobile

........Visit here.

https://www.steempro.com/

........SteemPro Discord

https://discord.com/invite/Bsf98vMg6U

If you like my publication, I will be gladly accepting your valuable consideration, a thousand blessings for your generosity @oscardavid79

✅ Vote @bangla.witness as lead witness please. Thank you for reading me grateful.....

Let's remember to comment on my publication, I will gladly answer you. This article is written by @OscarDavid79 free of copyright 🇻🇪 |

|---|

.gif)

Upvoted! Thank you for supporting witness @jswit.

Thank you for supporting

Twitter

https://twitter.com/oscardavidd79/status/1701030919211991420

Dear @oscardavid79 ,

We appreciate your active participation and contributions to our community. To ensure a positive environment for all members, we have implemented a set of guidelines to maintain respectful and constructive discussions while upholding community guidelines.

Kindly include the link to your canva graphic design

Now Engage, Connect, and Inspire Each Other to Reach New heights.

Thank You.