Are We Ready For Bitcoin's Blast Off?

We have talked for years about bitcoin adoption, and now, it might not be here, ever. But, bitcoin may become THE ASSET of the world.

Banks, investment firms, rich people, whales, are all buying up bitcoin. The amounts that we hear about are HUGE! And, the price really hasn't moved. Most speculate that it is because they are buying over the counter. And there are probably a lot of geeks who have a bitcoin stash, and $100k is a good price to sell and buy whatever it is you wanted. (if you have 100 bitcoin just sitting on an old harddrive)

Maybe Binance or Coinbase is selling customer's bitcoin to Black Rock's ETF, leaving an IOU. Which will cause someone to lose some money on their bets… as long as there is still liquidity in the market. As long as there is still someone willing to sell bitcoin at $100k.

Anyway, somebodies out there are stacking a lot of bitcoins. And we haven't reached the FOMO yet. What happens if big players, banks, investment funds, countries start FOMOing into the market?

What happens when all the exchanges are picked clean, no matter what the price is offered?

Is this an inevitability? Will we continue to have a bitcoin price? What of the Dollar? the Euro? the BRICS? What happens to all other assets?

The Future Price of Bitcoin…??!!

Bitcoin is going over a million dollars per.

After that, i do not perceive a price.

At least not until everything is priced in bitcoin.

After a point, bitcoin will be too rare, too valuable, and no one will sell it on an open exchange. We will hear about so and so, sold his super-yacht for two bitcoin, and that will be the only clues about how precious bitcoin is.

So, i consider the price of bitcoin will be:

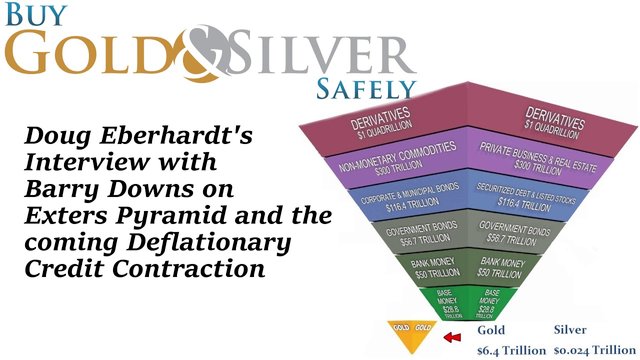

How much wealth makes it through the door, into bitcoin, before Exter's pyramid collapses / (divided by) 21 million

GoldSilver - Mike Maloney

Most of the derivatives are bets and counter bets that should have been cleared out long ago, but today it will take decades to unwind these really complex contracts. If any of this makes it into bitcoin, it will be because someone sold it at 10¢ on the dollar so they could get cash to buy bitcoin. I expect the derivatives layer to just evaporate.

I expect that most of the big commercial Real Estate to be abandoned. You can't afford the building's maintenance even if you got it for free. And the smaller stuff will lose value, but slower.

I hate to say this, but all groups, like municipalities, who have issued Bonds are going to default on those debts. They will just not be able to get cash to satisfy them. If they can't print money, expect them to have no money.

Stocks are a real conundrum in my analysis. When will the stock markets be shut down due to fraud? Until then, bitcoin and stocks will be in a race over who has the bigger market cap.

To sum up, most of the "money" is going to evaporate. This is not real money, it is just how much things were said to be worth.

If the entire financial system switched into bitcoin, it would be:

$1 Quadrillion / 21 million bitcoin

However, it will be more like

$100 Trillion / 21 million bitcoin

or maybe even less.

Bitcoin & Gold

Gold, gold, who has the gold?

Where is the gold in Ft. Knox?

Where is all the gold that The US stole?

What about the gold the Federal Bureau of Intimidation stole?

Soon, there will be a race between gold and bitcoin. Sorta…

There will be people saying, "We are going to have a gold backed currency!", but this time, with more emphasis! And maybe someone will actually get it implemented.

But, i feel that will be very hard to do as central banks horde all the gold they can get. Letting some of it out, would be seen as disastrous. But, i could see the BRICS doing something where the actual member nations could redeem BRICS-notes for gold. Trump may actually do something similar with the Dollar, but i do not think he will get it through congress.

At the same time bitcoin will become the means of exchanging large sums of money around the world. Large corporations paying each other. Govern-cements paying each other. That will all be on the bitcoin blockchain. People paying for yachts, fine art and super-cars will all be done in bitcoin.

As long as the electricity stays on, and internet works, bitcoin has every advantage over gold, (except physicality. But that will be fixed soon). So, bitcoin inevitably wins the race, and gold will become just a pretty yellow metal. However, it is the in between time that will be exciting!

Adoption?

The sad part is, i haven't even brought up adoption yet. And, i am not sure that adoption even comes into this picture. The general public isn't going to see bitcoin as valuable until everyone else sees it as valuable. When bitcoin passes one million dollars, then people will think, "drat, i should have bought some at $1,000" And then, people will only accept bitcoin if all other payment methods are gone/broken.

The best way to get crypto adoption (or gold adoption) is for all the banks to stop giving out money.

The next best way is for the black market to start using bitcoin, because other things are all tracked. (of course, Monero will probably be preferred in this case.)

And then, of course there is the CBDC method. Although, they won't call it that. Maybe the treasury starts giving out simmies on the XRP platform. Maybe Social inSecurity starts sending payments with RLUSD. The more people used to using crypto apps, the easier it is to just start using bitcoin.

It is just quite likely that all the rich, banksters and such start using bitcoin before the rest of the world.

Bitcoin will be a BIG part of our future (at least until better money comes along).

I just think that the course being taken is not what we envisioned four years ago. We envisioned a stead progression of bitcoin price as more people bought bitcoin and began using it, and adoption happens, and…

Instead, we will see something like $100,000 → $1,000,000 → All the money.

At some point things stop being valued in dollars, and start being valued in satoshis.

Well, at least the banksters will have to send bitcoin if they want anything. (unlike dollars, which they just print) So, even if they have all the bitcoin, they will have to give it away if they want to use it.

This time it is not the same

Stock to flow model fails to work when the items stops being a commodity and start being money.

The four year cycle breaks down when more than a small group of geeks want bitcoin.

Polling the exchanges stops working when there is no bitcoin on the exchanges.