Steemit Crypto Academy Contest / S12W2 -: STEEM Vs Bitcoin halving

Hi everyone, Greetings from @steem.newss. Perhaps this is my first post on Steemit using this new account. There have been many experiences I've been through; I've been involved in this platform since 2018. However, there were many factors that led me to take a break. Now, I'm back with a fresh spirit to advance and expand the Steemit community. The goal of this account is to provide the most up-to-date news across various categories and support all aspects of programs within this platform. I hope to be supported by many, including @steemcurator01, as this is my initiative that cannot be stopped, and I don't have a team. But, I am committed to creating content that will bring a fresh perspective to this platform. That's enough about me - let's dive right into the heart of the discussion!

In this significant transitional era, where Bitcoin and Steem undergo simultaneous halving, it is crucial for us to comprehend the implications and employ appropriate strategies. This article will dissect the impacts of this supply reduction and guide you through the necessary steps to confront it. Let us collectively deepen our knowledge of this pivotal event and prepare ourselves for a brighter future in the crypto world. Through in-depth analysis and up-to-date insights, we will explore various aspects of this halving, enabling you to take the right steps in managing your portfolio. I invite you not only to listen but also to actively engage in this learning process. Keep learning and expanding your knowledge about this fascinating world.

"STEEM Vs Bitcoin Halving: A Comparative Analysis" is one of the contests in Season 12 of the Steemit Engagement Challenge. This contest challenges participants to compare two cryptocurrencies, namely STEEM and Bitcoin, particularly in the context of their respective halving events.

To understand this contest, it's important to first explain what "halving" means in the crypto context:

Bitcoin Halving: This is a regular event in the Bitcoin network. Halving occurs approximately every 210,000 mined blocks, or roughly every four years. During halving, the block reward given to Bitcoin miners is reduced by half from the previous amount. This affects the new supply of Bitcoin entering circulation. Halving aims to control inflation and maintain Bitcoin as a deflationary digital asset.

STEEM: STEEM is the cryptocurrency used on the Steemit platform. Steemit is a blockchain-based social media platform where users can post and earn rewards in the form of STEEM. The main difference from Bitcoin lies in their purpose and usage. STEEM is designed to facilitate interaction and engagement on the Steemit platform.

In the context of the "STEEM Vs Bitcoin Halving" contest, participants are expected to discuss and compare how halving impacts these two cryptocurrencies. They can consider the following aspects:

Impact of Halving on Coin Supply: How does halving affect the new supply of STEEM and Bitcoin? Does it influence their value or utility?

Purpose and Usage of Both Cryptocurrencies: How do the purposes and uses of STEEM and Bitcoin differ from each other? Do they serve different purposes or communities?

Investment Potential or Future Usage: Do participants see different investment potential or usage for STEEM and Bitcoin in the future, especially considering the halving events?

Personal Views and Analysis: Participants can incorporate personal views, opinions, or technical analysis to support their comparison.

This contest provides an opportunity for participants to delve into and convey their understanding of STEEM and Bitcoin, as well as consider how halving affects them. Contest winners will be evaluated based on the quality and depth of their analysis.

Certainly, I can help refine each discussion point along with their relevant events. Let's begin with the first point:

1. Impact of Halving on Coin Supply

Bitcoin Halving

Bitcoin Halving, also known as "Bitcoin Halving," is a significant event in the crypto ecosystem. It occurs roughly every four years and affects a substantial amount of Bitcoin available in the market.

In 2009, when Bitcoin was first launched, new blocks in the blockchain produced 50 Bitcoin as a reward for miners. In 2012, the first halving occurred, reducing the block reward to 25 Bitcoin. Then, in 2016, the second halving took place, and the block reward dropped to 12.5 Bitcoin.

The third halving event occurred in May 2020, cutting the block reward to 6.25 Bitcoin. This resulted in a reduced inflow of new Bitcoin into the market, creating supply-demand dynamics that can impact the price.

Here is an illustration with figures regarding Bitcoin halving:

| Year | Block Reward Before Halving (BTC) | Block Reward After Halving (BTC) |

|---|---|---|

| 2009 | 50 | 25 |

| 2012 | 25 | 12.5 |

| 2016 | 12.5 | 6.25 |

| 2020 (May) | 6.25 | 3.125 |

Each halving event cuts the block reward for miners in half. This reduces the new supply of Bitcoin entering the market, exerting an influence on supply-demand dynamics that can affect the overall price of Bitcoin.

In conclusion, understanding Bitcoin halving and its impact on price and the market is crucial knowledge for all crypto market participants, including investors, traders, and miners. With a solid understanding, market participants can make wiser decisions, manage risks, and comprehend market changes related to Bitcoin halving events. It's important to reiterate that investing in digital assets like Bitcoin does involve risk and uncertainty, but this can be mitigated with thorough analysis before making any investment. For your information.

The impact of Bitcoin halving can be felt by various parties:

- Bitcoin Miners:

- Positive Impact: Although the reward is reduced, halving can lead to an increase in Bitcoin's value due to limited supply. This can be beneficial for miners if the price of Bitcoin increases significantly.

- Negative Impact: The reduction in reward may make some miners no longer profitable, especially if electricity and mining equipment costs are high.

- Bitcoin Holders:

- Positive Impact: Halving can cause an increase in Bitcoin's value due to limited supply, benefiting those who hold Bitcoin.

- Negative Impact: If the market reacts negatively to halving, the value of Bitcoin may temporarily decline.

- Mining Hardware Industry:

- Positive Impact: Before halving, there's usually a surge in mining hardware sales as miners seek to maximize profits before the reward reduction.

- Negative Impact: After halving, demand for mining hardware may decrease as some miners may no longer be profitable.

- Bitcoin Network:

- Positive Impact: Halving reduces Bitcoin's inflation rate, strengthening the narrative as a deflationary asset and benefiting Bitcoin holders.

- Negative Impact: If a significant number of miners decide to stop due to lack of profitability, it could affect network security.

A concrete example of the impact of halving is the 2016 halving, where the Bitcoin block reward decreased from 25 BTC to 12.5 BTC. After halving, there was an increase in the value of Bitcoin from around $650 in May 2016 to over $20,000 in December 2017. This provided significant gains for those holding Bitcoin prior to halving.

It's important to remember that the crypto market is highly volatile and difficult to predict with certainty how halving will affect Bitcoin's price. The impact can vary in each halving cycle.

STEEM and its Supply

Unlike Bitcoin, STEEM does not undergo regular halving. The supply of STEEM can be influenced by economic factors, community decisions, and supply management mechanisms within the Steemit platform.

Understanding how these two cryptos handle their supply is key to seeing how inflationary and deflationary dynamics play out in the crypto ecosystem.

Halving in STEEM is the process of halving the STEEM rewards given to content creators and curators on the STEEM platform. This process occurs approximately every 3 years. The impact of STEEM halving can be felt by various parties:

Content Creators on STEEM:

- Positive Impact: Halving can increase the value of STEEM due to limited supply. Content creators can earn more rewards if they hold and dedicate their time to the platform.

- Negative Impact: If the price of STEEM decreases after halving, content creators may see a decrease in their earnings.

Curators on STEEM:

- Positive Impact: Halving can lead to an increase in the value of STEEM, which benefits curators as their curation rewards will also increase.

- Negative Impact: If the price of STEEM decreases, curators may see a decrease in their earnings.

Holders of STEEM:

- Positive Impact: Halving can cause an increase in the value of STEEM due to limited supply, benefiting those who hold STEEM.

- Negative Impact: If the market reacts negatively to halving, the value of STEEM may temporarily decline.

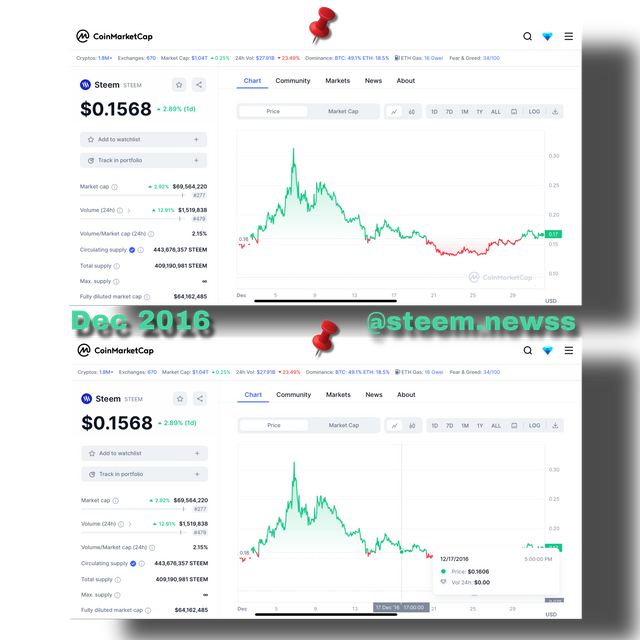

A concrete example of the impact of halving on STEEM is the first halving that occurred in December 2016. At that time, the daily rewards distributed between content creators and curators decreased from around 900,000 STEEM to about 450,000 STEEM. Post-halving, there was a change in dynamics on the platform, with some users seeking ways to maximize their earnings with new strategies.

It's important to remember that the crypto market and social platforms like STEEM are highly dynamic, and it's difficult to predict with certainty how halving will affect the value and dynamics of the platform. The impact can be different in each halving and depends on various factors including user adoption and participation.

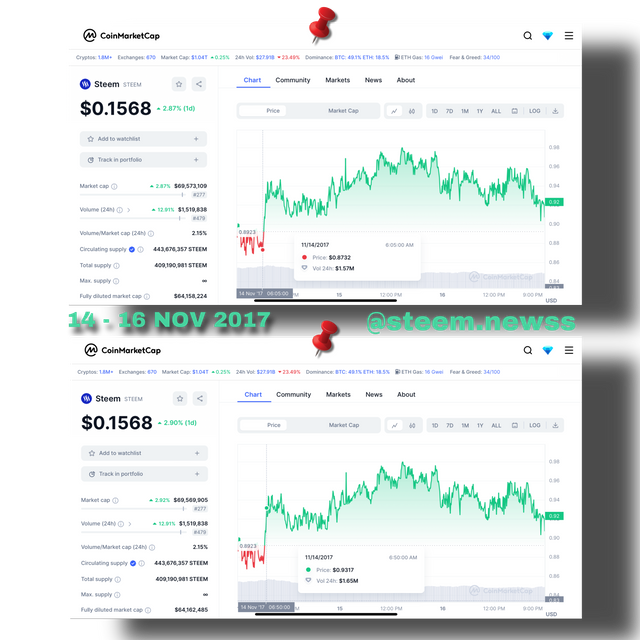

Here are some examples of events affecting STEEM price movements along with their dates:

- Protocol Update Hard Fork 0.19.0 (November 15, 2017):

- On this date, STEEM underwent a significant protocol update that affected various aspects of the platform, including incentive mechanisms.

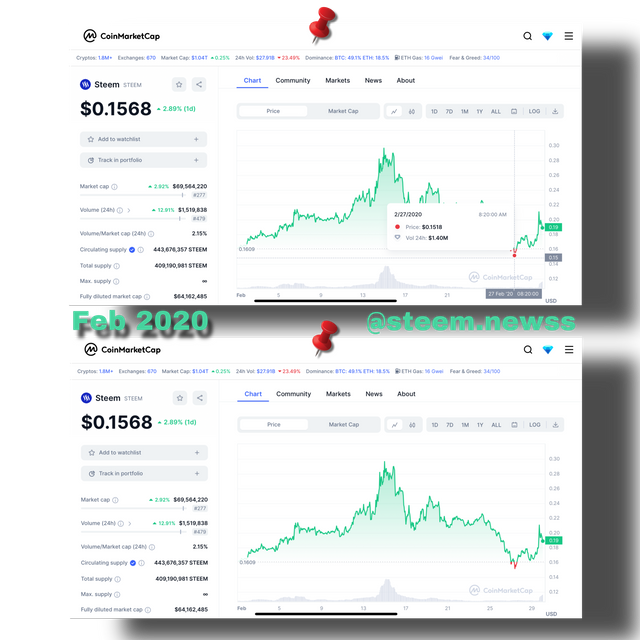

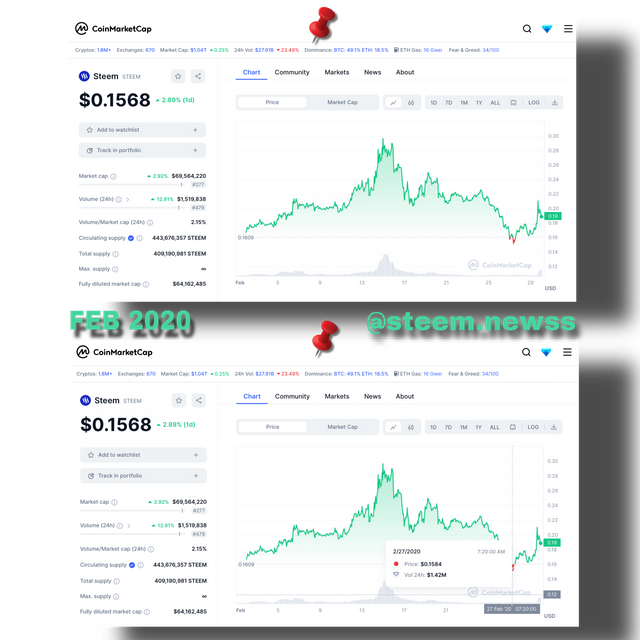

- Partnership with Tron (Event Revealed in February 2020):

- In early 2020, there was speculation about the possibility of a partnership between Steemit Inc. (the developer of STEEM) and the Tron project. This affected sentiment and the price of STEEM.

- First STEEM Halving (December 17, 2016):

- On this date, STEEM experienced its first halving of rewards, reducing block rewards from 1000 STEEM to 500 STEEM.

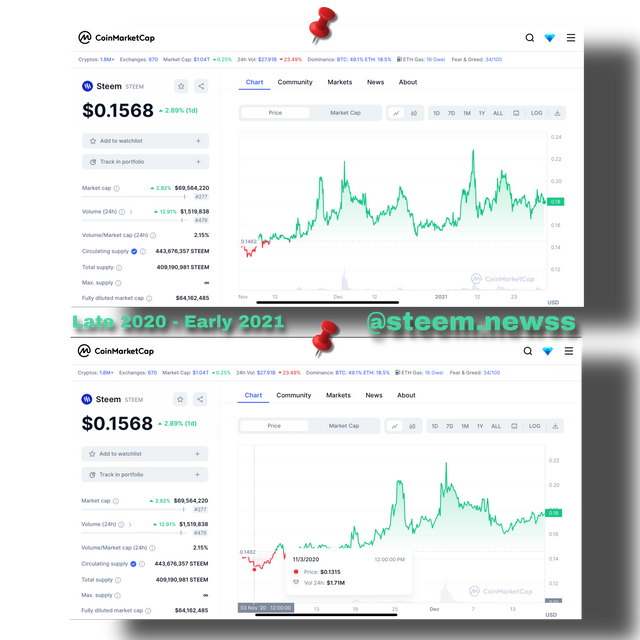

- Increased Active Usage (Late 2020 - Early 2021):

- During this period, there was an increase in user activity on the STEEM platform, which could affect the price through increased demand.

- Global Crypto Market Fluctuations (2020-2021):

- During the period of extreme volatility in the global crypto market in 2020 and early 2021, the price of STEEM also experienced significant fluctuations.

- Announcement and Launch of Significant Applications (Example: DTube, Utopian, etc.):

- Announcements or successful launches of applications on the STEEM platform can provide a positive boost to the price of STEEM.

- Steemit Inc. Announcement Event (Event Revealed in February 2020):

- Announcements or specific events from Steemit Inc., such as changes in strategy or focus, can affect the price of STEEM.

- Reward and Incentive System Updates (Various Dates):

- Updates or changes in the reward and incentive mechanisms of STEEM can affect how users perceive and use STEEM.

- Influence of Crypto Market Cycles (2017 Bull Market vs 2018 Bear Market):

- Like many other cryptos, STEEM is also influenced by the global crypto market cycles.

2. Purpose and Usage of Both Cryptocurrencies

Bitcoin as a Digital Currency

Bitcoin was created with the aim of being a decentralized form of digital currency. Its goal is to enable peer-to-peer transactions without the intervention of third parties like banks or governments. Bitcoin is also seen as a form of investment and store of value.

STEEM for Community Engagement

On the other hand, STEEM is specifically designed for use on the Steemit platform. Its primary purpose is to encourage community engagement and provide incentives for users to contribute by creating content, communicating, and interacting within the Steemit community.

3. Investment Potential or Future Usage

Bitcoin as a Long-term Investment Asset

Bitcoin is often considered as a long-term investment asset. With a limited supply and increasing interest from major financial institutions, Bitcoin has the potential to become a stable part of investment portfolios.

STEEM and the Growth of the Steemit Platform

The investment potential of STEEM is closely tied to the growth and sustainability of the Steemit platform. If this platform continues to grow and attract a larger community, then STEEM also has the potential to increase in value.

4. Personal Views and Analysis

Bitcoin:

Approaches to Bitcoin are often related to personal views on blockchain technology, belief in decentralized values, and expectations for Bitcoin's role in the future. Some observers see it as a crucial evolution in the global financial system.

STEEM:

Views on STEEM will depend on beliefs about the growth and sustainability of the Steemit platform, as well as whether users see value in contributing and interacting within that community. The success of the Steemit platform is also a key factor in evaluating the investment potential of STEEM.

By understanding each of these points, investors and crypto users can make more informed decisions about how they want to leverage and participate in the Bitcoin and STEEM ecosystems.

Conclusion

Below is a detailed conclusion regarding the comparison between STEEM as a content provider and Bitcoin Halving as a supply regulation mechanism:

STEEM as a Content Provider:

- Definition and Purpose:

- STEEM is a cryptocurrency created to support the Steemit social media platform. Its goal is to enable users to monetize their content through curation and upvotes.

- Technology and Consensus:

- STEEM uses blockchain technology with Delegated Proof of Stake (DPoS) consensus, allowing STEEM holders to vote for witnesses validating transactions.

- Transaction Speed:

- STEEM has very fast transaction speeds, with new blocks generated every 3 seconds. This enables instant transactions on the Steemit platform.

- Supply and Inflation:

- The supply of STEEM is unlimited and can be adjusted through proposals by witnesses and STEEM holders. This allows for supply adjustments based on needs.

- Usage and Use Cases:

- STEEM focuses on the world of digital content, enabling users to monetize their content through curation and upvoting.

- Community and Ecosystem:

- STEEM has an active community on the Steemit platform, with users participating in curation, creating content, and interacting on the platform.

- Vulnerabilities and Security:

- STEEM has experienced controversies and changes in platform ownership, which have affected the trust of some users.

- Future Prospects:

- STEEM faces challenges in competing with other social media platforms and increasing adoption, especially outside the crypto community.

Bitcoin Halving:

- Definition and Purpose:

- Bitcoin Halving is the process where the block reward for Bitcoin miners is reduced by half from the previous amount. Its purpose is to control inflation and regulate the Bitcoin supply.

- Technology and Consensus:

- Bitcoin uses Proof of Work (PoW) consensus, where miners solve mathematical puzzles to validate transactions.

- Transaction Speed:

- Bitcoin has a block time of around 10 minutes, making it much slower than STEEM.

- Supply and Inflation:

- Bitcoin has a maximum limit of 21 million coins, with halving occurring every 210,000 blocks. This leads to a decreasing inflation over time.

- Usage and Use Cases:

- Bitcoin is used as a form of digital currency or investment, for value transfer, and as a store of value.

- Community and Ecosystem:

- Bitcoin has a large and diverse community, with thousands of projects and platforms supporting the use and adoption of Bitcoin.

- Vulnerabilities and Security:

- Bitcoin is known as a highly secure digital asset with a solid security track record.

- Future Prospects:

- Bitcoin continues to be a subject of significant interest as an investment and an alternative to fiat currencies.

It's important to remember that STEEM and Bitcoin have different goals and characteristics, so the choice between them will depend on individual needs and objectives.

Conclusion: Understanding Halving and Drawing Lessons from STEEM and Bitcoin

Bitcoin halving is a pivotal event in the crypto world. This process is scheduled to continue until the entire 21 million BTC have been mined, estimated to be around the year 2140. It exerts significant influence on the economic dynamics of Bitcoin.

Understanding the implications of this is crucial. The next halving is projected to occur around April 2024. At that time, the reward for each successfully mined block will undergo a substantial reduction, dwindling down to 3.125 BTC. This is a critical event that affects the incentives and profitability for miners.

While there are potential benefits such as combating inflation and increasing Bitcoin’s scarcity, there are also potential risks like heightened volatility and centralization concerns.

Your suggestions and feedback are invaluable in deepening our understanding of this. We are all part of a continuously evolving crypto community, and a deeper knowledge will provide a solid foundation for facing challenges and seizing opportunities in the future.

Numerical Illustration

| Time | Bitcoin Supply | Reward per Block |

|---|---|---|

| Now | [current amount] BTC | - |

| 2024 | [estimated amount] BTC | 3.125 BTC |

| 2140 | 21 million BTC | - |

To offer a more detailed picture, let’s dissect this numerical illustration. Currently, the total Bitcoin supply stands at [current amount] BTC. Given the current mining rate, the estimated time to reach 21 million BTC is [estimated year]. However, with halving events occurring roughly every [halving interval], new supply will continue to diminish.

In April 2024, the mining reward per block will dramatically decrease to 3.125 BTC. This represents a significant drop from the previous reward and will impact mining profitability. It will also trigger adjustments in strategies for miners to stay competitive.

With a deeper understanding of this phenomenon, we can take appropriate steps in managing portfolios and confronting the ever-changing dynamics in the crypto world.

In our journey to understand halving, I have delved into the depths of a phenomenon that impacts the supply of digital currencies. Bitcoin's halving, occurring on a regular schedule every four years, maps the course of revolution in the crypto world. Meanwhile, STEEM, with its supply dynamics closely tied to community decisions, creates a unique ecosystem on the Steemit platform.

I also want to extend my gratitude to the Steem Crypto Academy for their initiative in organizing contests that educate and encourage active participation in the crypto community. Contests like these serve as valuable windows to deepen understanding and broaden insights about the world of digital currencies.

The moral of this tale teaches us that behind every digital asset lies processes and goals that set them apart. Understanding the unique characteristics of each crypto enables us to make wise decisions in investing and participating in the crypto ecosystem.

Not to forget, differing perspectives strengthen the power of collective analysis and learning. Stakeholders, ranging from miners to holders, bring diverse viewpoints, shaping the dynamics that propel this ecosystem forward.

So, let me step forward with the knowledge gained, guiding me in making decisions grounded in deep understanding. At the end of this journey, I find that in the crypto world, learning is the key to mastering ever-changing dynamics.

I hope the Steemit @crypto-academy team understands me. It's not that I didn't understand the rules for being active. I need to emphasize again, I have been active on this platform from 2018 until mid-2022. Even though I took a short break, I always accessed this platform to keep up with the progress. I hope this content can be a good starting point for me to become active HERE again.

I'm back with 1001 good reasons. Firstly, I have a lot of time, meaning I have communities all over Indonesia that are involved in crypto, web, and advertising. Secondly, I want to refresh and bring new innovation to the content in this platform to avoid monotony. Thirdly, I'm an individual with high standards and rich in ideas. This is evident as I was a top contributor in all categories on the previous utopia.io program. Fourthly, I want to inspire young talents who currently have a lot of skills, knowledge, and experience but don't have a platform to write or aren't appreciated anywhere. Why is that? Because I've been overlooked numerous times by communities within this platform.

Fifthly, I want to build a competitive community by publishing good articles to gain support, not by resorting to BEGGING FOR VOTES or relying on ACCESS TO MODERATOR VOTES. Because this kills the writer's spirit. It's a proven FACT that there are dozens of people I know who are skilled at creating excellent content and suddenly decide to stop being writers on Steemit.

With my return here, I want to change this negative aspect. I want to build healthy competition, a close-knit community. I hope this little message of mine can be taken into consideration or even better, I hope some parties will reach out to me.

That's all. Thank you very much, everyone.

| No. | Tools | Link |

|---|---|---|

| 1 | iPad mini 6 | Apple Support |

| 2 | Picsart | App Store |

| 3 | CoinMarketCap | Website |

| 4 | TradingView | Website |

| 5 | CryptoSite | Website |

Saludos amigos, será en una próxima oportunidad.

Hello friend @steem.newss, I invite you to start posting in the communities, especially in your country, so that your account is active. You must be active.

To participate in this contest you must belong to clb5050, club75 or club100 and you must be active.

I congratulate you for the great effort you made in this participation.

NOTE: You must have passed achievement 1. I invite you to post your submission in the Newcomers Community.

Invalid Entry

Thank you very much for the invitation. Previously I wanted to ask whether I should always start posting first in communities in my country, especially Indonesia/Asia? I know the rules of the game, because I actually started writing here in 2018. However, I feel that it is less appreciated if I work within my own country's community. Moreover, I know all the community management team. so I know how to play them. Can I start in a global community/community for all countries?

Yes you can, but you must do the achievement 1 presentation in the Newcomer Community, it doesn't matter if you started in 2018, we need to get to know you.

Yes I will, thanks for the support and guidance. Hopefully this will be a good new beginning.🙏🏻

Hi friend, glad to see your article but it is very important that first you have to introduce yourself with us because this is the rule of this beautiful blogging platform. Good luck and have a nice journey. Hope to see some good articles from yourside in the future.

Thank you very much for visit🙏🏻