WHAT DETERMINES THE PRICE OF BITCOIN?

Bitcoin has lost over half its value in less than 6 months. Shortly before Christmas, it was trading at over $19,000; today, it is just $8,299. Unsurprisingly, Bitcoin investors have been predicting meteoritic rises will recommence any day now. But Bitcoin has so far refused to cooperate, staying stubbornly stuck below $10,000 for the last two months. How can we know when - or if - it will rise again?

Cryptocurrency analysts Fundstrat think they have found a way of predicting the future price of Bitcoin. They used the expected path of breakeven Bitcoin mining costs to forecast that Bitcoin will reach $36,000 by the end of 2019:

fundstrat executive summary

fundstrat executive summary

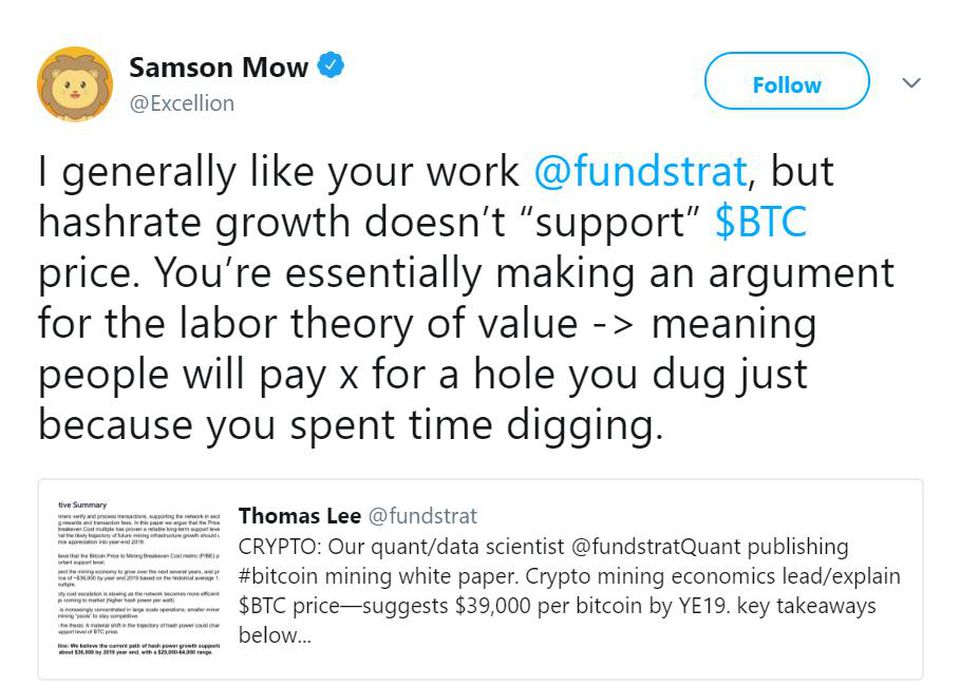

But this method has come in for considerable criticism from the Bitcoin community. On Twitter, Samson Mow, chief strategy officer of Blockstream, claimed that Fundstrat's forecast relied on a controversial economic theory:

The “labor theory of value” essentially says that the price of a good or service is determined by the work required to produce it. It is popular with Marxist economists, but most other schools of economics have abandoned it in favour of “subjective valuation” which says that the value of a good or service is whatever someone will pay for it, regardless of the effort that went into producing it. Mow’s argument is that subjective valuation is the right way to understand Bitcoin’s price dynamics, not the labor theory of value.

Of course, if the producer values the effort that goes into producing the good or service more highly than the market will pay, they will stop producing it. When prices fall, therefore, marginal producers tend to drop out, reducing the supply and hence raising the price. Producers who have inventories to run down and/or sufficient reserves to enable them to run at a loss may continue production for some time. But as time goes by, more and more producers drop out until prices rise enough for the market to clear.

Similarly, when Bitcoin’s price falls, marginal miners drop out, as the cost of mining bitcoins starts to exceed the rewards. However, this creates a security risk. As the mining pool shrinks, predatory attempts to seize control of the pool (a 51% attack) become more attractive. Bitcoin therefore has an automatic adjustment mechanism to discourage miners from dropping out of the pool when the price falls. The algorithmic puzzles that miners have to solve become more difficult when Bitcoin’s price rises, and less difficult when the price falls. This keeps the rate of bitcoin production steady, at 1 block approximately every 10 minutes, while allowing the hashrate (the computing power needed to solve the puzzles) to fluctuate with the Bitcoin price.

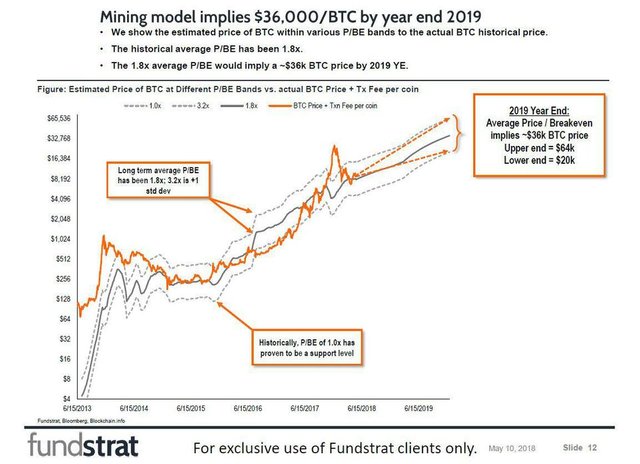

As the hashrate is effectively a measure of electricity usage, which is the main component of mining cost, miners’ breakeven costs tend to track the Bitcoin price. Fundstrat’s chart (also from Twitter) shows this clearly:

fundstrat

fundstrat

Since the price floor set by the difficulty adjustment ties breakeven cost and price together, the breakeven cost trend is a reasonable predictor of the future price of Bitcoin. Samson Mow's criticism is therefore a trifle unfair. Fundstrat hasn't relied on the labor theory of value, though its summary does somewhat misleadingly imply that the mining cost rather than the difficulty adjustment supports the price.

Of course, the support is asymmetric: Bitcoin’s price is supported on the downside, but not capped on the upside. This is because there is no need to defend against 51% attacks when the mining pool is expanding. However, it doesn’t seem to have occurred to anyone that massively rising breakeven costs create enormous barriers to entry which result in mining pool concentration. There may not be a 51% attack, but if the mining market becomes dominated by a small number of large players, the effect is much the same. Especially if those players cooperate.

And there is a second problem, too. Bitcoin trades much like a commodity. Over the long-term, the market price of commodities tends towards their marginal cost of production. Putting this another way, mining profits eventually fall to zero. As I noted earlier, when profits fall to zero, producers eventually stop producing.

But whereas commodities would still be traded if mining ceased, Bitcoin would instantly die. This is because the real job of miners is not bitcoin production, but transaction verification. Without transaction verification, bitcoins can’t be bought, can’t be sold, can’t be spent, can’t be earned. If mining ceased, existing bitcoins would become immovable - and an immovable asset is worthless. Thus, unlike a commodity, if mining profits fell to zero, so would the value of all existing bitcoins.

The difficulty adjustment artificially preserves the profit margins of miners to ensure that enough of them continue to mine. This protects Bitcoin from attacks, but it has serious implications for the financial sustainability of Bitcoin as a transaction system.

At present, new bitcoins are part of mining rewards. But the new bitcoin component of mining reward halves every few years. Eventually it will reach zero. As the difficulty adjustment forces mining profits to stay positive, falling profit margins – whether due to price falls or halving – must be offset by rising transaction fees. The users of the system will have to pay miners increasing amounts of bitcoin to keep them mining honestly.

In my view this means that viewing Bitcoin as a commodity is wrong. Miners provide a service – transaction verification – upon which the users of Bitcoin critically depend. Without that service, Bitcoin would die. But miners also depend for their profits on the willingness of users to transact. If the fees rose too high, users would stop using Bitcoin for transactions, and Bitcoin would die. The equilibrium transaction fee would be the point at which there are sufficient users to provide a reasonable volume of transactions for verification, and sufficient miners to perform verification honestly.

Ultimately, what determines the value of Bitcoin is whether people are willing to transact using it. That includes buying and selling bitcoins, of course, since trading is transacting. But will the Bitcoin price continue to rise steeply enough for users to remain willing to pay ever-higher transaction fees? Or will there eventually be a “death spiral” triggered by falling prices as users leave the system en masse, followed by miners giving up as collapsing transaction volumes force fees down to zero?

Vote exchange site https://mysteemup.club

Hi, thank you for contributing to Steemit!

I upvoted and followed you; follow back and we can help each other succeed 🙂

P.S.: My Recent Post