Decentralized Crypto Exchanges vs Centralized Exchanges

The biggest threat to cryptocurrencies is not volatility, as most assume. Instead, it is the fact that 99% of cryptocurrency trade still happens on centralized exchanges.

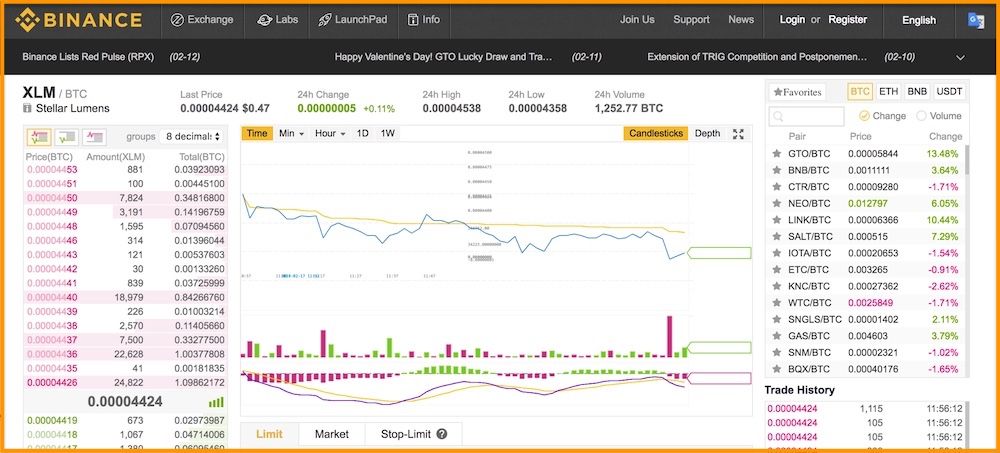

Sometimes I think how contradictory it is to use centralized exchanges like Binance or Bittrex against the ethos of decentralized cryptocurrencies.

It is a shame that the whole purpose of monetary sovereignty for which Satoshi Nakamoto created Bitcoin is still at the helms of centralized parties.

But I feel that the time is not very far when we will see this trend changing. In fact, it has started to change as numerous decentralized exchanges are proliferating with their different approaches.

Centralized Crypto Exchanges

We all know about some famous centralized exchanges such as these:

- Bittrex

- Binance

- Coinbase

- Bitfinex

- BitMex

- Kraken etc…

No doubt that since the beginning centralized exchanges made cryptocurrencies like Bitcoin, Ethereum etc accessible to the masses around the world. I also acknowledge the fact that they did a very good job in providing the much needed push and liquidity to crypto markets.

But they also had their fair share of criticisms and failures. Some of which were:

Exchange hacks: More than 30 cryptocurrency exchange hacks in last 9 years with some of them as big as Mt.Gox, BitGrail, Coincheck etc.

Govt ban: The China ban, the Korea ban, and the Russia ban etc.

Poor Support: Anyone who has used a central exchange knows of this problem.

Such bans and hacks happen because when you buy cryptocurrencies on centralized exchanges, like Bittrex or Binance, you don’t actually own them. It is so because these exchanges don’t give you the private keys of your funds. Instead, they just credit appropriate crypto numbers against your order.

Also, there is an additional headache of KYC compliance and identity document submission that one has to do while using such centralized services. And this opens you to another vulnerability of identity theft or your personal identity information getting leaked via centralized exchanges.

Not just this, nowadays popular centralized exchanges are not listing most of the ICOs or token sales because of the increased regulatory pressure from the US SEC and rest of the world. Exchanges like Bittrex and Poloniex have not listed any ICO token for months now which can result in liquidity issues for good ICOs or token sales.

Fun Fact: Decentralized exchanges can list any ICO or token because they can’t be shut down as there is no single point of failure in their model. There is no server to shut down!

Decentralized Exchanges (DEX)

Because of the aforementioned limitations and issues, I kind of agree with what Vinny Lingham recently tweeted.

Of course not all exchanges will fail but the failure of some major exchanges, coupled with governments cracking down on centralized exchanges, can catalyze the emergence of decentralized exchanges.

The reality is that we are not there yet, despite many decentralized exchanges in the pipeline. It is so because decentralized exchanges have all the inherent limitations of blockchain technology and one of them is scalability.

Some of those decentralized exchanges and protocol are:

- Cryptobridge

- EtherDelta

- Bisq

- 0x

- OasisDex

- Kyber Network

- Bancor Protocol

- AirSwap

- WavesDex

- OmegaOne

- Altcoin.io

- BarterDex

- Nxt

- Counterparty Dex etc.

Also, almost all decentralized exchanges that are in operation today, give you the feeling of old-age internet websites that are slow and sometimes unusual due to lack of enough traffic on it. And when you don’t have enough buyers/sellers on an exchange, it is akin to the death of that platform.

But like I mentioned earlier, the crypto regulations, bans and hacks will catalyze the development of decentralized exchanges. And you should definitely expect better user experience and liquidity on DEXs because smart contract techs like off-chain atomic swaps and on-chain atomic swaps are going to make the cryptocurrency exchanges peer-to-peer and trust-less very soon.

Conclusion

Decentralized exchanges will soon be a household name because that’s the only way cryptocurrencies can thrive given the bans and regulations.

And the development of so many DEX and DEX protocol clearly shows that the pioneers of cryptosphere have realized that if cryptocurrencies need to go mainstream, beyond the FUD, we will definitely require peer-to-peer censorship-resistant decentralized exchanges in the market.

However, the exchange of cryptocurrencies into fiat currencies like USD, EUR etc is a lot harder to be decentralized because systems like US Dollar itself are centralized.

And that’s why you see low volumes on exchanges like LocalBitcoins and Bisq.

Interestingly, this problem can also be solved by having cryptocurrencies that are pegged to fiat currencies. The classic example of such a cryptocurrency is Tether. Unfortunately, Tether was recently accused of market manipulation for they did not have USD reserves in proportion to the actual Tether (USTD) that they had issued.

But this can be done easily, in a fair manner, by keeping a stringent auditor in place. Some of the fiat-pegged currency projects are coming up that provide the much needed liquidity, fairness and fiat interaction needed in the market. And this will definitely serve as a cure to fiat on/off ramp problems that decentralized exchanges might run into in the future.

Needless to say, all the missing pieces for creating a robust infrastructure of decentralized exchanges are coming together. That is why it is wise not to do away with decentralized exchanges now, no matter how good your favorite centralized exchange is.

Thanks ronnn, some interesting information here!

You just received a 31.98% upvote from @honestbot, courtesy of @ronnn!

You got a 3.01% upvote from @getboost courtesy of @ronnn!