*Crypto Challenge Fast Asset Classifications.}}

Observers before the U.S. Place of Agriculture Committee at an open hearing July 18 were consistent in their view that computerized resources entangle the rigid qualifications of existing administrative structures.

The hearing was led by Texas U.S. Delegate Michael Conaway, who met six famous observers to give declaration — previous Goldman Sachs accomplice and U.S. government controller Gary Gensler, Andreessen Horowitz overseeing accomplice Scott Kupor, the CFTC's Daniel Gorfine, law teacher Joshua Fairfield, Clovyr CEO Amber Baldet, and Perkins Coie overseeing accomplice Lowell Ness.

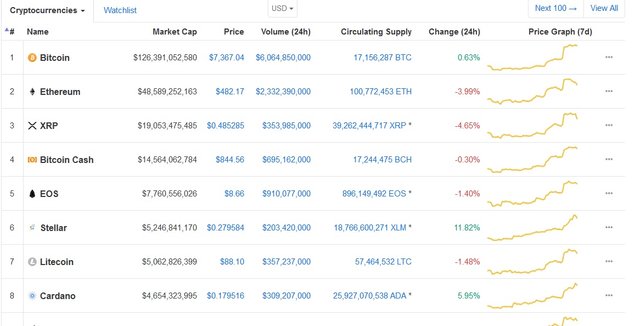

A key takeaway from the hearing was that a given computerized resource may move its administrative status as it changes starting with one setting then onto the next, given the smoothness of the crypto biological system.

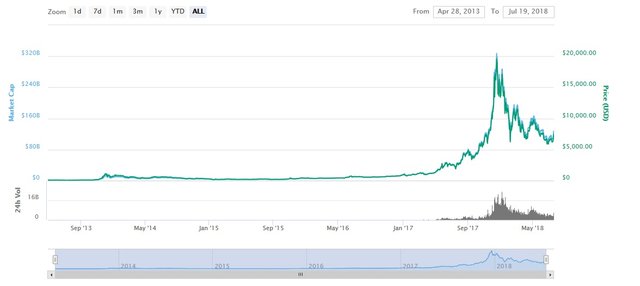

Both Gensler and Fairfield contended that when an advanced token is promoted at a "pre-useful" minute in its improvement — i.e. amid an Initial Coin Offering (ICO) — then the deal is judged a venture contract and along these lines a security to be controlled by the Securities and Exchange Commission (SEC)

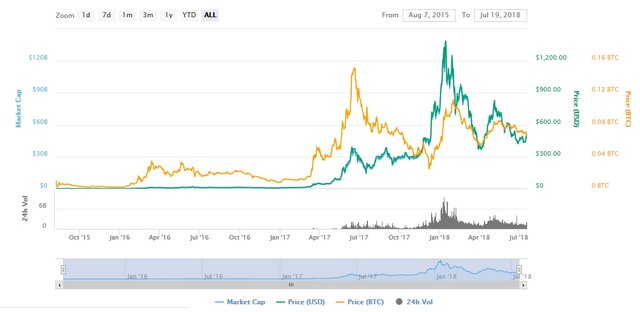

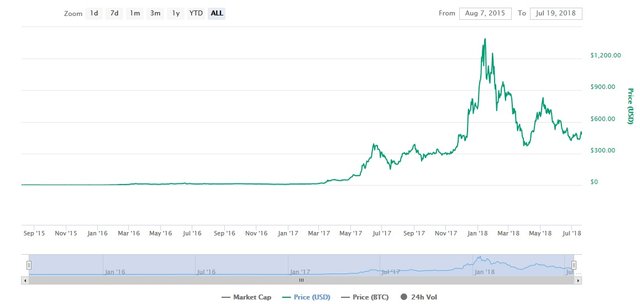

Basically, be that as it may, crypto tokens may stop to be securities once they wind up utilized as a part of a decentralized system as an utility token as, on account of Ethereum (ETH). This implies an advanced resource may at one point be a SEC-directed security, just to later turn into an item of importance to the Commodity Futures Trading Commission (CFTC).

As Gorfine plot, the CFTC does not by and large exercise coordinate oversight of the fundamental item advertises themselves, but instead controls subsidiaries, for example, the fates or swaps markets.

Gensler suggested that condition of the "fundamental money crypto markets" is by and by, "best case scenario a wild west," and that the CFTC conceivably requires greater specialist and assets to manage the test. The SEC, as far as it matters for its, could require 2-4 years to address the "thousands" of "rebellious" performers in the ICO space, he said.

Ness cautioned that over-forcefully expanding securities arrangements could truly obstruct the crypto space, which has developed accurately to make a system that takes into consideration "esteem exchange at the speed of programming."

The SEC prominently requires that the useful responsibility for resource can be resolved at any given time, something that Gensler said was not yet innovatively doable to accomplish frictionlessly in the crypto space.

In light of board individuals' worries that crypto can be utilized for illegal exercises, Kupor proposed that "Bitcoin is law requirement's closest companion," given that pseudonymous exchanges can at last be followed utilizing insight devices that break down movement on the blockchain.

Ness jested that "the affirmed Russian programmers were gotten in light of the fact that they utilized Bitcoin," in reference to the ongoing prosecution that accused twelve Russian nationals of utilizing crypto to fuel their endeavors to "meddle" in the 2016 U.S. presidential decisions.

In mid-May, a U.S. House Subcommittee hearing on blockchain in supply chains reasoned that the innovation has an assortment of uses, even without vast gauges.

Starting Coin Offerings (ICO) "fizzled" to give assurance against insider exchanging or adhere to their whitepaper guarantees, another report from the University of Pennsylvania Law School discharged July 17 uncovers.

The extensive investigation of the ICO wonder, named "Coin-Operated Capitalism," starts with a forthcoming examination of financial specialist desires versus reality, the four contributing educators discovering essential irregularities in the conduct of a "noteworthy" number of undertakings.

In the initial remarks, they express that their "request uncovers that numerous ICOs flopped even to guarantee that they would ensure financial specialists against insider self-managing. Less still showed such contracts in code." The paper proceeded,

ICOs keep on generating blended responses in the midst of late outrages burdening a portion of 2017's most lucrative token deals.

Bancor, which wound up well known for bringing $153 mln up in three hours last July, saw a hack worth $12 million this month result in far reaching feedback of its decentralization and reasonable administration claims.

In their paper, the UPenn law teachers utilize Estonian budgetary establishment Polybius for instance of guarantees gained in the whitepaper against genuine ground post-token deal.

As per the paper, Polybius, who raised $31 million through their ICO in June 2017, incorporated into its whitepaper "a few claims that would lead us to expect certain highlights straightforwardly coded into tokens or other keen contracts," proceeding,

Digital currency industry figures have in the mean time kept on safeguarding ICOs as a honest to goodness raising money show, notwithstanding exceeding the advantages of more conventional means.

In May, Binance CEO Changpeng Zhao established that "fund-raising through ICOs is around 100 times simpler than through customary VCs, if not more."

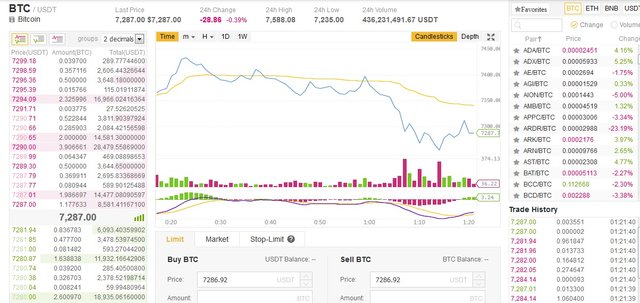

@sohaibomer all market based on bitcoin and bitcoin is going to touch 10k$ and other altcoins also going higher and who holds the coins become rich at the end of this year

@umar1144 woow. Well that is looks an incredible news. I likewise consider that may it will must address 10K$. Numerous number of financial specialists lay on it, And may they will must endeavor to contribute increasingly and more.Keep it up.

Congratulations @sohaibomer! You have completed the following achievement on Steemit and have been rewarded with new badge(s) :

Click on the badge to view your Board of Honor.

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Do not miss the last post from @steemitboard:

SteemitBoard World Cup Contest - The results, the winners and the prizes

@steemitboard pleasure is mine, That's for telling me. I hope We may keep It up. that give batter to batter result with that steem.