Boeing’s Black Swan

According to Investopedia.com a black swan is an unpredictable event that is beyond what is normally expected of a situation and has potentially severe consequences. One immediate example is COVID-19 and the havoc its causing within the equity markets. But before COVID-19, Boeing had their own black swan.

It’s been over a year now that the Boeing 737 Max 8 had back to back (within five months of each other) crashes killing all on board. The first crash was a Lion Air Boeing 737 MAX 8 which plunged into the Java Sea shortly after taking off from Jakarta, killing all 189 people on board. The second crash was with Ethiopian Airlines killing 149 passengers and eight crew members on board shortly after takeoff.

Immediately after the Ethiopian Airline crash, Ethiopia, China and Indonesia, Caribbean carrier Cayman Airways, Comair in South Africa and Royal Air Maroc in Morocco temporarily grounded their Boeing MAX 8s as a precautionary measure. This was shortly followed by all 737MAX 8 planes around the world being grounded.

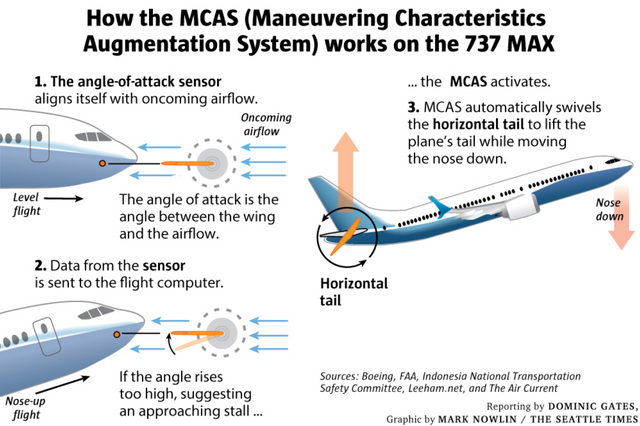

The culprit, the Maneuvering Characteristics Augmentation System (MCAS), a system to improve the 737 Max plane’s handling, but was suspected of reacting to errant sensor data.

So I was surprised when I saw an article yesterday published by Benzinga talking about bullish usual option activity in Boeing.

Because of COVID-19 and despite airline companies canceling flights left and right, single passenger flights are starting to become the norm. For example, eight out of 119 American Airline flights out of Washington DC were single passenger flights. Do you think American Airline needs more planes?

On Wednesday, Benzinga Pro subscribers received two option alerts related to unusually large trades of Boeing options:

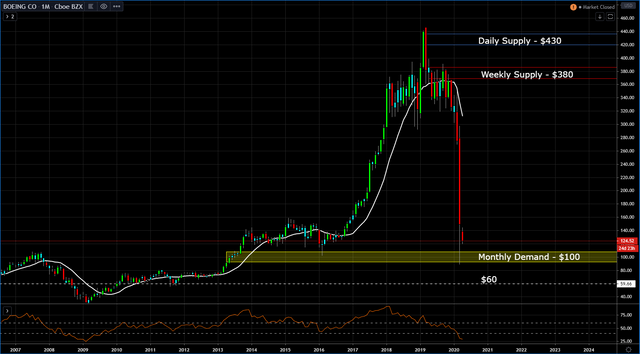

At 9:30 a.m., a trader bought 1,465 Boeing call options with a $170 strike price expiring on Sept. 18 near the ask price at $21. The trade represented a bullish bet worth $3.07 million.At 1:01 p.m., a trader bought 509 Boeing put options with a $100 strike price expiring on April 17 near the ask price at $4.651. The trade represented a $236,735 bearish bet.

Even traders who stick exclusively to stocks often monitor option market activity closely for unusually large trades. Given the relative complexity of the options market, large options traders are typically considered to be more sophisticated than the average stock trader.

I'm personally not feeling the bullish trade. Yeah, price reacted to the monthly demand at $100, but I would be surprised to see price go down to the $60 level.

This post is my personal opinion. I’m not a financial advisor, this isn't financial advise. Do your own research before making investment decisions.