STOMACH Turning: Crypto FLATLINING!

*** High Priority ALERT: Two days ago, our team was able to obtain a report, citing a massive short position by a number of specialty funds, targeting BLOCKStrain Tech (TSX-V: DNAX & US: BKKSF). This is the primary reason shares have plummeted severely, and I wrote a personal letter to the exchange to investigate whether the short positions are legitimate and to what their extent is. This is one of the reasons we need blockchain, so that transparency will allow us to find out who these bad actors are. In the meantime, we’re fighting gravity. Conserve your capital, until the hawks prey on someone else or the stock price hits CAD$0.17, a level in which the business would be priced so attractively that it wouldn’t matter what the short funds do. ***

BITCOIN’S PAST, PRESENT AND FUTURE AT A GLANCE

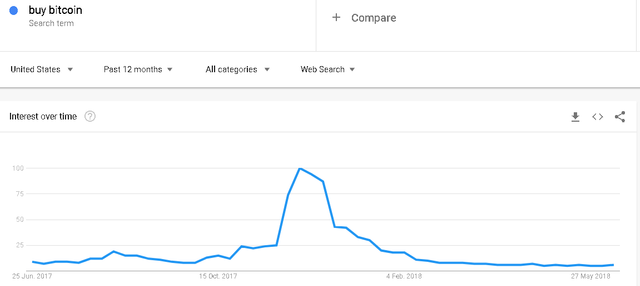

There’s nothing quite like a chart to project the truth in your face.

Courtesy: GoogleTrends.com

This graph is eerily similar to the chart of the actual price of BTC. It helps to present the case that in November and December of 2017, the interest in BTC was 8 times its October interest, and close to 10 times today’s fascination with it.

Now, more than at anything time before, you need to ask yourself why you are personally fascinated with cryptocurrencies.

Your answer will determine how you act, going forward.

There are three main reasons to own cryptocurrencies, as we view it:

- Profit From Price Change: Unlike the truly early adopters in 2009-2014, who were passionate about the revolutionary aspect of transacting peer-to-peer, cutting the banks out and building a new ecosystem, the investors of 2017 were predominantly making decisions, based upon their rosy projections of $25,000, $100,000 and $1,000,000 per coin.

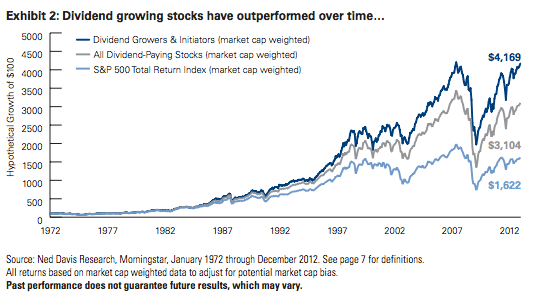

Remember this, because it serves as a great lesson – over the long-term, assets, which do not produce cash flow or profits, have underperformed the assets, which do.

Cash has underperformed gold, which underperforms bonds, which underperform stocks. Within the universe of stocks, the dividend-payers are the rulers, with dividend-raisers the undoubted kings.

Courtesy: Contrarianoutlook.com

Over the course of one’s investment career, the most important idea I can plant in your mind is to keep the majority of your net worth with dividend-raisers, but only buy them when they trade at attractive valuations.

After you’ve established a core portfolio, built to last, you can speculate all you want with cryptocurrencies, micro-cap stocks or exotic investment opportunities.

The disciplined thing to do is to patiently build a portfolio for highly successful businesses, which you buy over time.

It’s not the fastest way to become wealthier from investments, but it is the surest.

For example, I just bought a massive position in Owens & Minor (OMI), a health logistics company, which has a 6.16% dividend yield, but it’s also extremely cheap for such an established company, which serves thousands of clients.

Combined with my real estate holdings, cash flowing assets make up 73% of my net worth. These investments make sure that, over the long term, 3 out of every 4 dollars that I invest end up growing.

With the remaining 27%, I hold a large cash position, since I want to be ready to jump on opportunities, as they present themselves. This is another disciplined decision, since most investors can’t stand “sitting on idle cash,” but it is imperative.

In 2008, for example, cash was king.

- Use Cryptocurrency For Transactions: This should become a bigger reason to own cryptocurrency, if the industry wants to reach mass adoption.

This was the only original use-case, but building a worldwide web of crypto users is proving to be lengthy and difficult, with governments blocking and hampering use.

Yet, a portion of the population is already living in the crypto world.

If this is your primary goal with cryptocurrency, then today’s vast network of users makes it safer for you to move money around this way, obviously.

- Hold Purchasing Power Outside Main Banking System: This is the “Digital Gold” use-case.

Individuals may decide to decouple their funds from the risk of a fiat currency crisis by holding crypto in cold storage.

All three reasons are viable, but it’s important to understand that they are interconnected.

Holding “Digital Gold” only works if everyone decides that a certain coin is stable enough to act as a safe haven. The reason they would decide this is because many people want to use it, which might bring a speculative aspect to that coin, attracting traders.

At the end of the day, building a massive fortune with cryptocurrencies has just become harder than ever – it’s truly critical to realize that the game has changed, because now you’re competing with many other investors, who are also hunting for the next innovation.

Keep this in mind and always stick to the $3 Rule.

Make sure that you invest $3 in cash flowing assets for every $4 you risk.

Then, you’ll have a long, prosperous and rich career.

Best Regards,

Brad Robbins

President, PureBlockchainWealth.com

Legal Notice:

This work is based on SEC filings, current events, interviews, corporate press releases and what we’ve learned as financial journalists. It may contain errors and you shouldn’t make any investment decision based solely on what you read here. It’s your money and your responsibility. The information herein is not intended to be personal legal or investment advice and may not be appropriate or applicable for all readers. If personal advice is needed, the services of a qualified legal, investment or tax professional should be sought.

Please read our full disclaimer at PureBlockchainWealth.com/disclaimer