Check out IDEX: A Decentralized Smart Contract Exchange That Support Real-time Trading

It’s most likely that your first entry into the world of cryptocurrency will occur through an exchange. As such, you need a secured, transparent and fast exchange that will give you a smooth transition, and I really do think IDEX is one of the best exchanges around that can assist you with that.

What is IDEX?

IDEX is a decentralized smart contract exchange which is built on top of the Etherium blockchain, and first of its kind to support real-time trading alongside a very high rate of transaction. There are quites alot of Etherium based decentralized exchange, but IDEX has been recognized to be the most sophisticated decentralized exchange on the Etherium blockchain due to its ability to fill multiple trades at once, the cancelling of gas-free, and the supporting limit and market orders.

How does IDEX work?

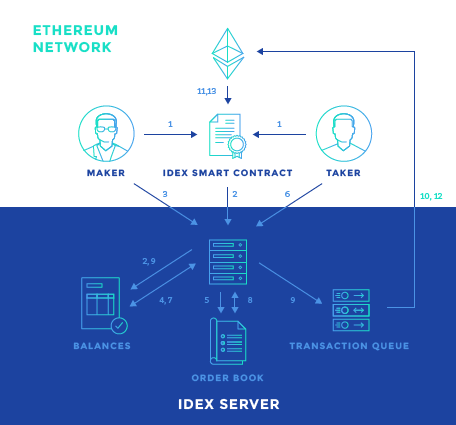

The working principle of IDEX is backed by three core components which is a smart contract, a trading engine, and a transaction processing arbiter. The work of the smart contract is to held all assets in storage and initiate an execution of trade settlement, with an expected authorization and confirmation of all trades by the private key of the users.

The smart contract of IDEX is different from that of other decentralized exchanges in its design in such a way that signed trades can only be received by Etherium through the authorization of the exchange. This gives IDEX the responsibility of having full control over the processing of transaction order while activating the seperation of trading act from final settlement.

The private keys of IDEX users are used in the authorization of trade in the contract, with an occurence of the regular update of exchange balances happening at the same time as they carey out their trade. The cancelling of any trades that has been completed is made impossible as a result of the authorization, and this same authorization is also what stops IDEX from starting any trades that has not been authorized by the user’s private key.

The authorized transactions are then received by the arbiter which deals with the management of a waiting list of pending transactions, which is then passed on sequentiall for further processing to ensure that the mining of each transaction is done in the right order and that the balance of the smart contract matches the exchange balance. What makes IDEX unique is the features of both centralized and decentralized exchange it possess, in the sense that it provides the audability and security of decentralized exchange in connection with the user experience and speed of centralized exchange to its users just by taking full control of the sequence of transaction.

An analysis of the transaction process of IDEX is given below:

A deposition of token is made by the maker and taker into the smart contract of IDEX.

The address of the users and the token balance associated with that address comes up immediately after the database of IDEX is updated.

A new order is created and submitted by the maker, which initiate a transaction with the transaction data inclusive, to be signed, and activate the execution of future trade immediately the smart contract is authorized.

A review of the order is then put in place by IDEX to launch a confirmation that there is enough funds in the maker account and that all information contained in the signed contract is not different from the ones on IDEX database.

The order is then added to the orderbook once all checks in part 4 has been confirmed to pass.

An order on the orderbook is seen by the taker, who make a submission of the trade to fill it and further get a transaction signed with no different trade data, with an execution of the trade immediately after the smart contract is authorized.

IDEX will check the order and verify that there is enough money in the account of the taker and that all the information in the signed transaction is no different with the information provided to IDEX.

when all checks in the part 7 have been confirmed to have passed, the transaction is marked as matched, and there will be an update done on the orderbook to give an indication that the order has been succesfully completed.

An update is done on the database of IDEX immediately after the last transaction is carried out to ensure that the new balances of the traders is reflected on their database. Successive trades can be done by traders based on the resulting balance after the update. At the same time, the signed operations of market makers and takers are added to the waiting list for transfer to the Ethereum network for processing.

The transaction of the maker is immediately transferred to the etherium blockchain once the trade associated with it is been reached in the waiting list.

The mining of the maker’s transaction is activated and at the same time, there is an addition of the order to the internal order book in the smart contract.

The transaction of the taker is transaferred to the etherium blockchain after a mining of the maker’s order is completed.

A mining of the taker’s trade is also activated and an update of the balances in the etherium blockchain is put in place to mirror or show the trade.

Major features and benefits of IDEX

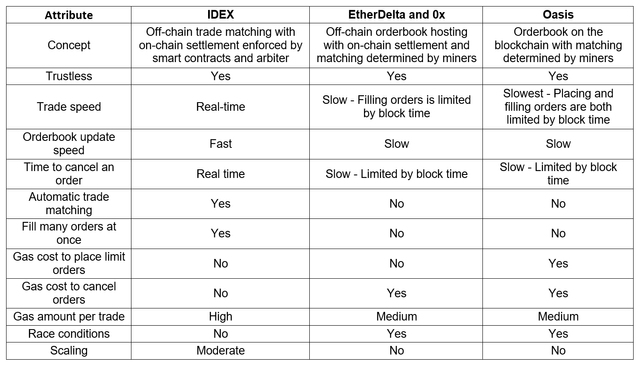

exchange compared to other existing Ethereum-based decentralized exchanges are shown in the image below as seen on medium page

Transaction fees: Note that a transaction fee of 0.1% and 0.2% applies to market maker and market taker respectively on IDEX.

Minimum Trade order: You should also note that an equivalent of 0.15 ETH and 0.05 ETH is the minimum order for makers and takers accepted by IDEX resoectively.

Some terms you should understand

Market Makers: They are the ones responsible for the placement of new orders on orderbooks while in wait for the order to be matched by another user.

Market Takers: They are the ones responsible for finding orders that are existing on the books and fill them, and removing orders from the books as a result.

For more Information, click here

Hi, @olasamuel!

You just got a 0.61% upvote from SteemPlus!

To get higher upvotes, earn more SteemPlus Points (SPP). On your Steemit wallet, check your SPP balance and click on "How to earn SPP?" to find out all the ways to earn.

If you're not using SteemPlus yet, please check our last posts in here to see the many ways in which SteemPlus can improve your Steem experience on Steemit and Busy.