BITCOIN HAVLING--How many blocks are remaining.

Greetings,

It's your friend @mondraye and today I will be talking about Bitcoin halving.

After giving this some thought, my thoughts eventually turned to the upcoming Bitcoin halving. The recent events in the cryptocurrency market have left many people wondering what the future of cryptocurrencies holds.

We must first comprehend Bitcoin block reward in order to fully comprehend Bitcoin halving.

Simply put, a block reward refers to the benefits granted to miners following the successful mining of a block.

Also known as the bitcoin incentive paid to miners for validating a block, it can also be thought of as such.

Therefore, the incentive paid to validators for successfully validating a block can be referred to as a bitcoin block reward.

It is a recompense given to validators for completing the challenging problem needed to mine a Bitcoin block.

The name "Bitcoin halving" originated from the fact that, following the successful mining of a sizable number of blocks on the blockchain, the block reward for Bitcoin is often half, or divided into two.

A cryptocurrency-related occurrence called the "Bitcoin halving" happens every four years or so. Additionally, once it happens, it divides the cost of the Bitcoin block reward in half, lowering the overall supply of bitcoin in circulation.

After 210000 blocks have been verified, Bitcoin halves, which happens roughly every 4 years.

Its block reward was 50 bitcoins per block mined in 2009, the year it was first created. After its first halving in 2012, it was reduced to 25 bitcoins, and after its second halving, it was reduced to 12.5 bitcoins per block mined.

On May 11, 2020, it underwent its most recent halving event, which decreased its mining reward to its current value of 6.25Btc per block mined.

By reducing its inflation, the BTC price halving event helps to increase its marketability.

The inflation rate of BTC was 50% in 2011; it was decreased to 12% following its initial halving in 2012; to 4-5% in 2016; and most recently, it is now around 1.76%.

The price of bitcoin rises as a result of the bitcoin supply being halved, which is another effect.

As the pace of bitcoin inflation declines, there will be less bitcoin available, raising demand.

And this drives up the cost.

Take bitcoin as an example. In 2016, when it underwent its second halving, it was trading around $650. A few months later, however, the price of bitcoin rose to $20,000. This demonstrates the impact of the price of Bitcoin halving.

It also lessens the amount of bitcoin granted to miners in exchange for validating a block, which has an impact on them.

For instance, the Bitcoin block reward in 2012 was 25 BTC, but it is today 6.25 BTC every block mined.

Remember that I said that after mining 210000 blocks, bitcoin experiences a halving.

Since its creation, Bitcoin has now endured three halves.

Here are some quick statistics on the halving of bitcoin.

| DATE | BLOCK REWARD | BLOCK HEIGHT |

|---|---|---|

| 9th-Jan-2009, 2:54:25AM GMT | 50BTC | 1(Genesis block) |

| 28-November- 2012,03:24:38 PM GMT | 25BTC | 210000 |

| 9th-July-2016, 4:46:13 PM GMT | 12.5BTC | 420,000 |

| 11th-May-2020, 7:23:43PM GMT | 6.25BTC | 630,000 |

From what we have seen above, the last halving occured on the 11th of May, 2020 after the completion of 630,0000 blocks.

Knowing that halving occurs after the completion of 210,000 blocks, the next halving will be expected to occur after the completion of 630,000 + 210,000 = 840,000 blocks.

- Current block height.

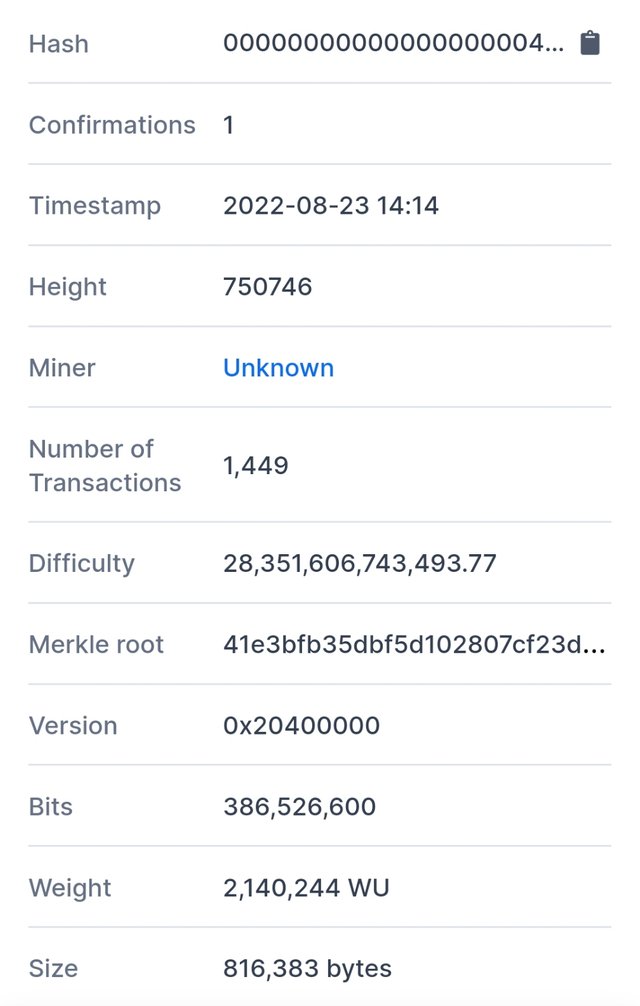

As at the time of this post, the current block height which is the total amount of Bitcoin mined is 750,746 as seen on the screenshot above.

Therefore the number of blocks remaining before the next halving can be calculated using the below formula:

Nbr=(K+L)-C

Where;

Nbr = Number of Blocks Remaining.

K = Is a constant which represents the Number of block height required for a havling to occur (210,000).

L = Number of block height during the last halving.

C = Current number of blocks heights.

We have;

Nbr = (210,000 + 630,000) - 750,746

Nbr = 840,000 - 750,746

Nbr = 89,254 blocks.

From the above calculation we have 89,254 blocks of Bitcoin remaining for the next halving to occur.

According to projections, the next Bitcoin halving will take place on March 2, 2024, at 7:45:53 AM GMT, with a block height of 840000 blocks.

When it does, the block reward for Bitcoin will be lowered to 3.125Btc.

Now I know why many analysts believe this bear market will finish in 2024. And I think that the price of Bitcoin and all other Altcoins will increase as a result of the bitcoin halving.

10% to @Tron-fan-club

You have brought out the topic in a very nice way through explanation and analysis. A wonderful educational post. Thanks for sharing

Thanks for appreciating my content. It is indeed educational and with that we can be sure to know when to expect the next bull run

Wow... You've shared a wonderful and educational crypto related content, the Bitcoin halving will play the biggest role in the next Bull run

Exactly...If we are to win in this crypto space it will demand a lot of patience because waiting for the next bull run won't be easy but it will be worth it 100%

Yay more Crypto! So much more than money.

Upvoted👍 Reshared🔁

Note: You must enter the tag #fintech among the first 4 tags for your post to be reviewed.

Very brief but contains a lot. Interesting topic to read on. Thanks for sharing.

You have put down an excellent article concerning the bitcoin halving and this will help the crypto world in an up trend manner.