How will blockchain change the car industry?

Blockchain could put the automotive sector in the fast lane. In 2017 almost 1.9 million battery-powered cars took to the road, according to Hamburg-based research portal Statista. In the future millions more ‘web-connected electric cars will flood our highways while health and safety regulations will ram the motor industry from all sides.

The car industry may get a blockchain boost – but what exactly it will look like remains to be seen

Some of this connected information – a mass of algorithms second-guessing humanity’s safety – may need to be secure and private. For an immutable, secure network that’s an opportunity.

The next opportunity could be motor insurance. Stick the details on a blockchain ledger and the risk of fraud could fall. Speeding, mileage and vehicle use could be collated to build quotes.

Then there’s car security. A car manufacturer might issue a private key to a new owner when a vehicle is sold. Access for family or friends could be added onto a smart contract. Good news for the citizens of Romford and Ilford, who saw the highest reported theft of cars in the UK – 13.5 per 1,000 in 2018 according to moneysupermarket.com.

Your future car insurance premium may be based on how far you allow your insurer to track you

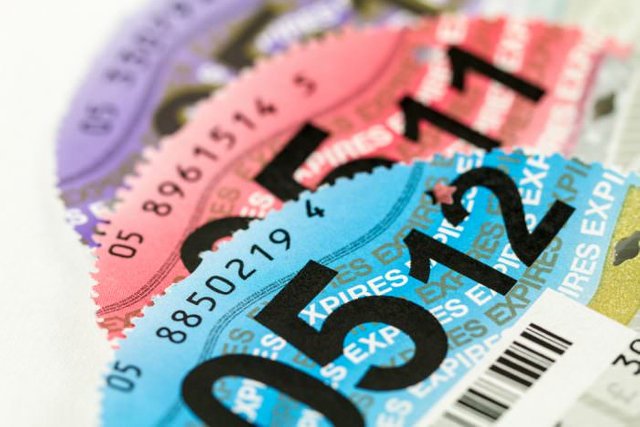

Shared ledger opportunities for the car industry appear to pop out everywhere. And that’s without a mention of the Driver and Vehicle Licensing Agency (DVLA), the UK’s register of all things vehicular. Paper’s not dead in Swansea yet, though the DVLA did kill off the paper tax disk in 2014.

DVLA has put the tax disc out of its misery – but e-progress is slow

Super-advanced and super-antiquated, the car industry screams out for a blockchain trim upgrade. Let’s scrutinise the options list and bench-test some of the hype.

Insurance recalibration?

Judgement-heavy (and often arbitrary) insurance categories such as driver occupation and postcode could recede. A 2017 Greater London Authority survey estimated 7% of London’s 1.9 million car-owning households used their vehicle for one hour a week or less. Blockchain pay-per-mile evidence instead could go to the insurer helped by Internet-of-Things technology. Why pay for cover if the car’s not being used?

Ken Marke, chief marketing officer for the Blockchain Insurance Industry Initiative (B3i), has worked for Direct Line, Eagle Star and Ageas. But he’s cautious on claims of blockchain-linked cost savings. “Gut feel says you might not see anything for quite a few years,” he told OpenLedger.

Terry McCann and Arthur Daley knew all about ‘nebulous’ benefits – credit Stuart Axe

For most contracts there’s the insurer and the insurance buyer he says. “That’s a network of two. How is blockchain going to help? It doesn’t help at all. Where it might help more is in the supply chain, or the car claims process.”

He adds: “It’s quite nebulous to see where the benefits are coming in personal lines [basic insurance services] at this point.” (Even in 2018 some remaining corners of the insurance market still heave with paperclips, Tipp-Ex and filing cabinets.)

Slow lane start

Mark Williams, brand strategist for Autohorn Fleet Services, echoes some of Marke’s caution on financial services. “We’ve found car finance companies and dealership groups tend to fall behind modern technology by a couple, if not several years,” he told OpenLedger. “Only recently have they embraced automatic KYC [know your customer] credit checks and accepting electronic signatures for contracts.”

Golf GTi – could pricier insurance for quick cars start to get cheaper, even for younger drivers?

He adds: “To get them to grasp what blockchain tech can really do is a long way off, and they will only adopt if it’s proven to make a positive impact.”

There could be blockchain opportunities on the commercial claims side. But an inviolable version of The Truth – something blockchain claims to nail – is tricky for multiple players. Especially if they’re strung along an underwriting network where contracts get renegotiated quarterly, often.

“People may be trading information on different spreadsheets and PDFs,” Ken Marke from B3i adds, “and human beings get things…wrong.”

Accidents happen – human beings get things wrong

Adaption issues

David White is the chief operating officer of Autoblock which offers blockchain services to the car industry, from valuations to buying and selling a car with cryptos. Their connected technology can even track and measure when a car is driven particularly hard – this level of forensic detail may help to build resale values in future.

“Twenty years ago,” White says, “the response I got from car dealers about websites was, Oh, it’s a fad. It was incredibly difficult to get traction.”

Apple is working on a car but progress is slow – that’s not a good sign at this late date

“Like it or not,” he says, ”kids are doing everything online. They don’t need laptops. It’s hand-held devices. They want to buy and transact online from start to finish. Dealers have got to adapt.”

Recently a high level source told White that Volkswagen UK was actively preparing for the death of the car showroom.

Sales frustration

UK car dealers are followers, not leaders he says. “When I ring a dealer,” says White, “and I say ‘Have you a few minutes to talk about cryptos?,’ there’s an inaudible sigh. I tell them there are more than four million users of crypto in the UK that can’t buy cars they want to.”

From Lamborghini franchises and other high-end marques, he’s spoken to more than 100 car businesses. Many get daily crypto enquiries themselves, White claims.

McLaren Senna Special Edition – not cheap but a quick deal possible with cryptos

Last month he had a call from Dubai. His UAE contact had an unsold McLaren Senna Special Edition, valued at £750,000. The point? “All these crazy cars… There’s incredible wealth in crypto circles from young, talented people.”

But the lack of UK crypto infrastructure is frustrating sales action he says. “Dealers need to start opening their eyes a bit more.”

Goodbye sheepskin coats

While they’re still around, at least. White predicts in future decentralised showrooms of stock where people have a quick drive, then finish the deal entirely online. One industry insider told OpenLedger many dealers were making very little money. “Much of the ultimate margin comes from finance deals.” Or from dealers hitting very tight sales targets – provided they do, of course.

A big car dealership costs a lot of money to run – and this cost is always paid by the buyer, used or new

These are questions that manufacturers are also asking themselves. “To run a decent-sized car dealer costs a million quid,” the source said. “So the manufacturers are asking themselves why they need the dealer. It’s not necessary any more.”

Strip these layers out and costs disappear for both car maker and car buyer. Indeed,up to 50% of UK forecourts will have gone by 2025, predicts KPMG in its 2018 Global Automotive Survey. Though a bit of forecourt bunting could hang on at a decentralised warehouse, the salesman role is looking much less relevant.

But not a total write-off. A boutique re-invention backed by sophisticated customer analytics might just see a re-birth: Arthur Daley [dodgy car dealer in the popular 1980s TV show Minder] re-digitized. With the help of crypto the job might still be a nice little earner.

Don’t write off Arthur Daley yet; credit Stuart Axe

Can blockchain help with PCP deals?

Personal contract purchases (PCPs) are a popular way for people to get new vehicles regularly without ever actually owning them outright. Mark Williams, from Autohorn Fleet Services thinks this is an area ripe for blockchain’s disruption. “If blockchain can reduce how much a car’s value depreciates, then it’ll definitely help with the average cost of PCP contracts

“One way, it could do this is informing the driver of data relating to their driving in real time, such as speed and mileage-to-date, and make recommendations that could minimise depreciation.”

Three key trends:

- Blockchain might help car owners buy infotainment or customer services says Deloitte. Think cashless payments for tolls, parking and electric charging

- Blockchain solutions might manage billing and payments when an electric vehicle owner (EV) charges their vehicle at a charging station

- And…as EV range increases “this will place more emphasis on maintenance of parts and vehicle refurbishment.” That, in turn, might encourage more parts verification opportunities adds the accountancy giant. Blockchain could shift the

Post written by Adrian Holliday

Adrian has written about investing for 20 years, from Teletext to the Observer and AOL. He is a believer in diversity, low transaction costs and the future of fintech.

Follow OpenLedger!

It's the reality, brands like Audi and BMW are in quite innovative project

Upvoted.

DISCLAIMER: Your post is upvoted based on curation algorithm configured to find good articles e.g. stories, arts, photography, health, etc. This is to reward you (authors) for sharing good content using the Steem platform especially newbies.

If you're a dolphin or whales, and wish not to be included in future selection, please let me know so I can exclude your account. And if you find the upvoted post is inappropriate, FLAG if you must. This will help a better selection of post.

Keep steeming good content.

@Yehey

Posted using https://Steeming.com condenser site.

Here's the another way on how Blockchain will change the the whole car Industry! CarVertical will be the one to changed that and to managed all the problems that cV has!

https://www.carvertical.com/blog/autonomous-future-bringing-iot-benefits-to-everyday-life