Global data: How high is China's housing prices? Second only to Venezuela! Higher than you imagine

It is said that China's housing prices are very high, so how high is it? I saw a set of data today and looked at it carefully. It is really the second highest in the world! In fact, it is the highest. Is China so good to go to Venezuela?

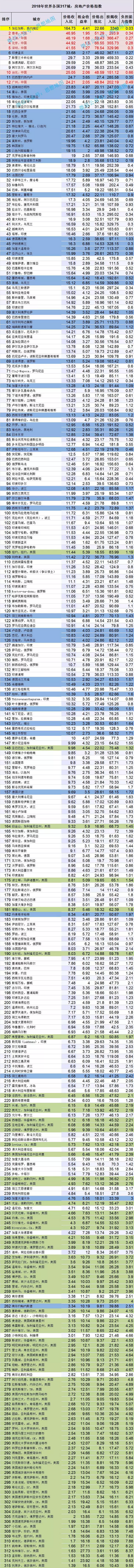

The chart is very long, the first picture is 317 cities in the world, and the second picture is in 91 countries. I posted it at the bottom, you see it yourself. The red letter is China, the green color is the United States, and the blue color is the main city of the major countries in the world.

Country (region) ranking, the world's first in Venezuela, 2nd in Hong Kong, China, 3rd in mainland China! In terms of cities, there are 6 cities in China, all of which are in the top 12, and 4 cities in the mainland are selected, namely Shanghai, Beijing, Shenzhen, and Guangzhou, with rankings of 3, 4, 5, and 12 respectively.

Source: Numbeo is the world's largest user-submitted city and country-related data resource website, providing instant and up-to-date information on living conditions around the world, includthe ing cost of living, housing index, health care, transportation, crime and environmental pollution. The data is more authoritative.

There are two indicators in the world that are widely used to evaluate housing prices. They are the price-to-income ratio and the rental yield (rental-to-sale ratio).

The price-to-income ratio is the total annual housing price, such as the total rent of 2 million, the annual income of 100,000, then the price-to-income ratio is 20. The world-recognized price-to-income ratio is reasonably 4-6. Some people say that it is 4-8. In fact, the relationship is not big, because the Chinese data is too high. Such a small reasonable range adjustment has no effect at all. The price-to-income ratio, in other word, is how many years to buy a suite. It is reasonable to buy a suite in 4-6 years. If the value is 46, it means 46 years to buy a suite.

The rental yield is the annual rent ÷ total price. (The rental-to-sale ratio is the ratio of the monthly rent to the selling price of the house. For example, if the rent is 20,000 a year and the total price of the house is 2 million, then the rental yield is 1%.** A reasonable rental yield is generally 3.3%-6%.**

How high is the price-to-income ratio in mainland China? Shanghai, Beijing, Shenzhen, and Guangzhou are 46, 44, 41, 24 respectively! It is nearly 10 times higher than the reasonable range! Of course ,you can say that the first-tier cities, while the third- and fourth-tier cities are not that high. Then let's take a look at other cities.

According to the National Bureau of Statistics, the average national house price in 2017 was 7,900 yuan / square meter, and the per capita disposable income in the first half of 2018 was 14,063 yuan. The price-to-income ratio is 28! Numbeo's data is 27, which can be said to be very accurate. In other words, the overall price-to-income ratio of the Chinese state is five times the reasonable range!

Looking at the first picture, the most expensive city in the United States is New York, but it ranks only 108 in the city, and there is absolutely no way to compare it with half of China’s top 12. Almost all cities in the United States are after 200. The chart shows that the front row is all red in China, and finally ,all are green and oily American cities. Many cities in the United States can buy 1 suite for one year's income, which is too abnormal.

The overall national housing prices in the United States ranked the second lowest in the 91 countries with statistics on Numbeo data! What about China? Ranked 2nd in the positive ranking! Further up is Venezuela!

Can we make a reasonable guess: US wealth is developing technology, and Chinese wealth is in infrastructure (real estate).The trade war was fought, they banned the chips, and we banned the house.

The top-ranked big country is Brazil with a ranking of 13 and the price-to-income ratio is 18. Indonesia ranks 24 and the house price-to-income ratio is 13. What is Japan that has always been said to be a real estate bubble? Rank 47, the price-to-income ratio is 12. France, Russia, India, Italy, the United Kingdom, and Germany are ranked lower.

This set of data is very interesting, you can take a look at the situation in each country.

Thank you for your patience, forwarding support, Thank you!

.gif)